Oil and Gas Companies Drive Hydrogen Investments Despite Overall Decline in Cleantech Funding

Key Ideas

- Oil and gas companies are increasing investments in hydrogen startups, tripling the number of deals compared to the previous year, despite a general cooling of interest in hydrogen by energy investors.

- Investments in hydrogen startups include backing for companies like Elemental Advanced Materials, Hystar, Supercritical, Advanced Ionics, Snowfox Discovery, and Hycamite TCD Technologies.

- Hydrogen is seen as critical in the industry's decarbonization efforts, with major players like BP emphasizing the importance of staying relevant in the hydrogen economy.

- While cleantech investments have seen a decline, carbon capture technology startups are maintaining a steady fundraising pace, and IT investments remain a significant draw for capital in the industry.

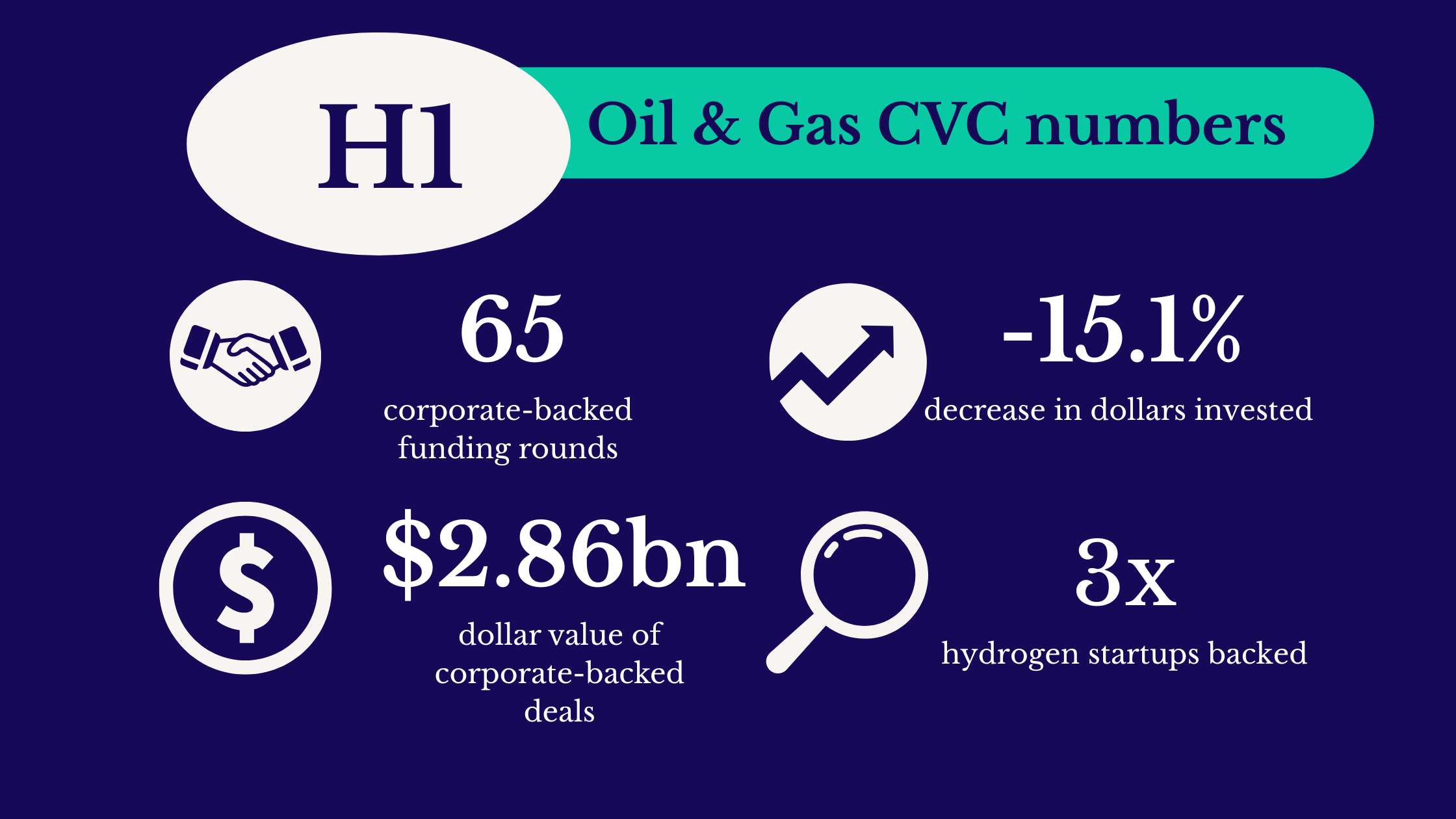

Oil and gas companies have significantly increased investments in hydrogen startups in the second quarter of 2025, with the number of deals more than tripling compared to the same period last year. This rise in hydrogen investments comes at a time when overall interest in hydrogen is decreasing among energy investors, particularly in green hydrogen. Despite this trend, oil and gas majors are continuing to invest in a variety of hydrogen-related startups, showing a positive sentiment towards hydrogen as a key player in the industry's decarbonization efforts.

Some notable hydrogen investments in Q2 included companies like Elemental Advanced Materials, Hystar, Supercritical, Advanced Ionics, Snowfox Discovery, and Hycamite TCD Technologies. The industry views hydrogen as crucial for decarbonization in sectors like industrial and transportation, where the shift to hydrogen is seen as a way to replace liquid natural gas.

While cleantech investments have experienced a decline, carbon capture technology startups are maintaining a steady fundraising pace. IT investments remain strong, with digitization being a significant priority in the industry. Despite an overall decrease in investment dollars in Q2 2025 compared to the previous year, large outlier deals of over $100 million have seen a resurgence.

However, one sector that has seen a sharp drop in investment is transport and mobility, with only one deal each in Q1 and Q2. This contrasts with previous years where companies like BP and Shell heavily invested in the mobility sector. The lack of new investments in transport indicates a shift in focus within the industry.

Oil and gas companies are preparing to inject more capital into the market, with initiatives like Brazil's Petrobras seeking to run a new $89 million VC fund for startups in renewable energy, electromobility, and other sustainable technologies. China's Sinopec is also investing heavily in the hydrogen economy with a new $690 million VC fund, reflecting a global interest in hydrogen technologies. Additionally, there have been exits by oil and gas companies, showing a dynamic landscape of investments and acquisitions in the industry.

Topics

Green Hydrogen

Venture Capital

Carbon Capture

Transport Sector

Energy Industry

Oil And Gas

Investment Trends

Technology Startups

Cleantech Funding

Latest News