SFC Energy AG Receives Positive Recommendation Despite Q1 Performance Dip

Key Ideas

- First Berlin Equity Research recommends buying SFC Energy AG stock despite Q1 2025 figures being slightly below the previous year.

- Q1 2024 had a major order to India, which boosted performance, but Q1 2025 remains the second-best in the company's history.

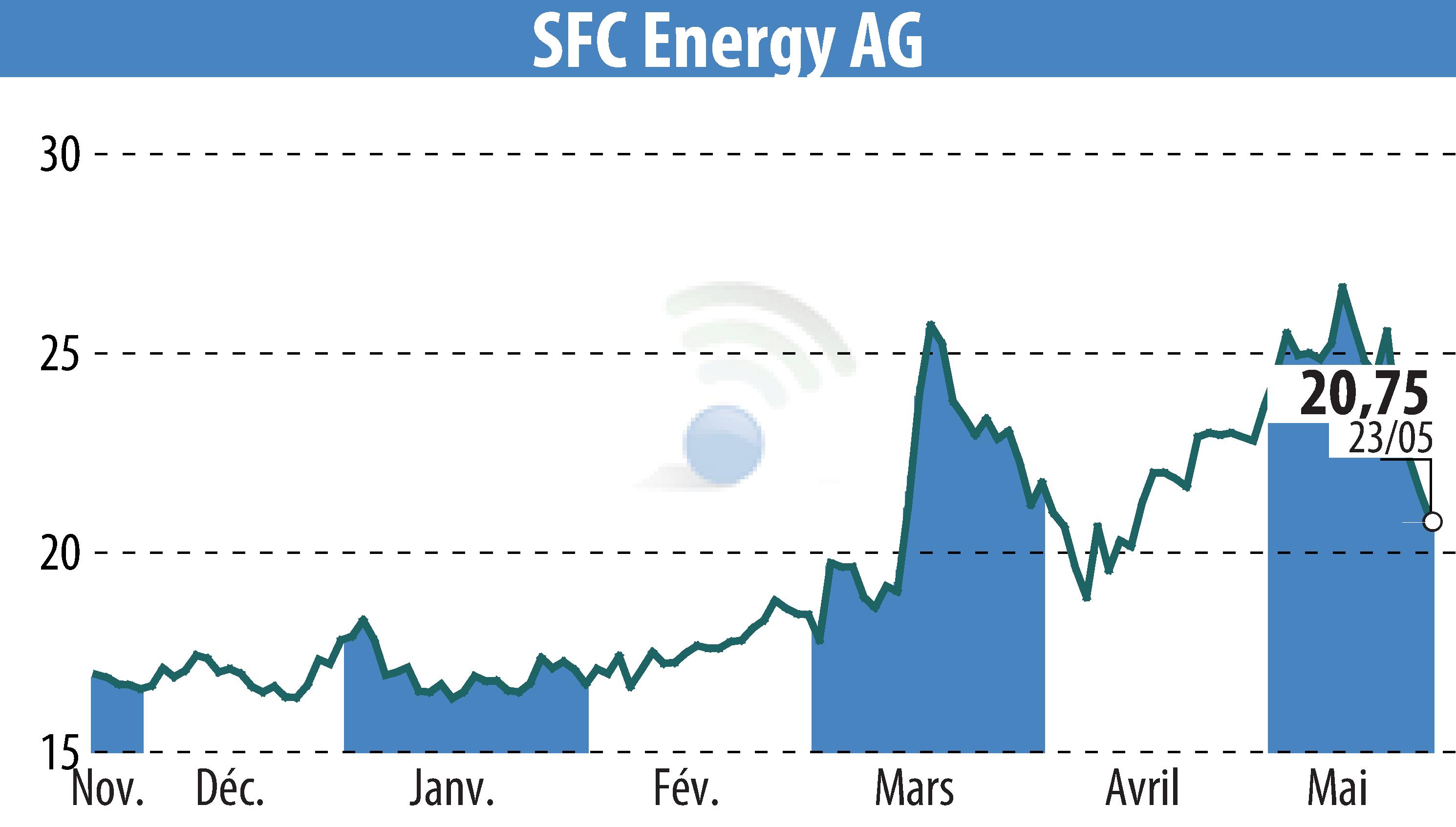

- Investors reacted to weaker Q1 figures with a share price decline, but SFC Energy AG is optimistic about growth, especially in hydrogen fuel cells and defense.

- The company reaffirms its 2025 guidance with expectations of strong growth at high margins, emphasizing new business prospects in Scandinavia and public security.

SFC Energy AG, a company recently analyzed by First Berlin Equity Research, received a positive recommendation for its stock despite Q1 2025 figures being slightly below the previous year's performance. The Q1 2024 numbers were significantly boosted by a €10 million order to India, which made this year's figures comparatively weaker but still the second-best in the company's history. This led to a temporary decline in share price as investors reacted to the unexpected results.

However, SFC Energy AG remains optimistic about its growth prospects. The company highlights strong potential from its new Scandinavian hydrogen fuel cell business and significant opportunities in the defense and public security sectors. Despite the initial market reaction, SFC Energy AG is confident in its 2025 guidance, anticipating robust growth with high margins. The reaffirmation of their guidance showcases the company's commitment to capitalizing on favorable business conditions and emerging opportunities in various sectors.

Topics

Fuel Cells

Stock Market

Investment

Energy Sector

Company Performance

Growth Opportunities

Business Outlook

Latest News